Is EuroDry a Value Trap? Or Does Management Hold the Key to Unlock Value?

We lay out a few ways EuroDry could unlock value and reverse a long trend of trading at a steep discount to NAV.

EuroDry (Nasdaq: EDRY) has been a perpetual ‘value trap’, trading at a steep discount to NAV, 30% of NAV! With a friendly and steady management team, we dive a bit deeper to see what value, if any, could be unlocked and better understand the inner workings of the large Pittas family holding through Friends Investment and Family United Navigation.

The Company is run by CEO Aristides Pittas and his trusted CFO Tasos Aslidis. They are also the CEO/CFO of ESEA, the container-shipping Company. Both Companies trade at a discount to NAV.

Mr. Pittas comes from a long legacy of seafarers and shipowners, dating back 130 years, and Chairs the family investment vehicles, which we will dive into later. But first an overview of performance.

EDRY ran up last year before tumbling back with the recent softness in the dry-bulk market. They are in a battle with GRIN for the worst performing dry-bulk stock over the last 13 months.

The Company has 10 vessels across age ranges. According to the maritime and commodity data platform Marhelm (Website / Twitter), we see that EDRY trades at a significant discount to their ~$50/share NAV.

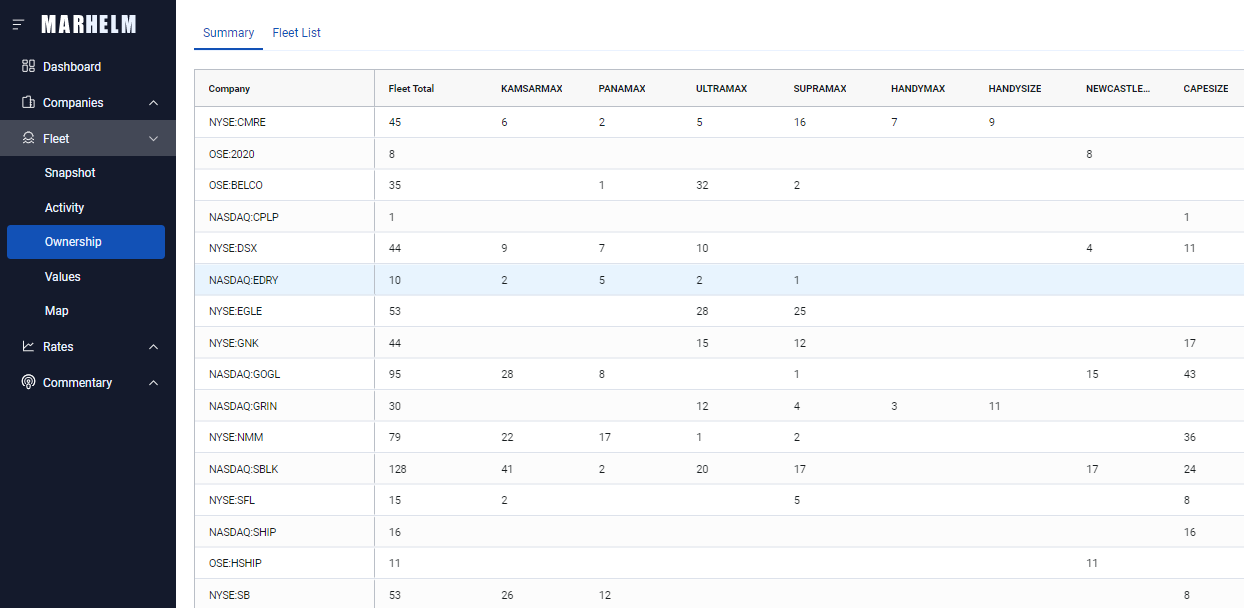

With an average age of 13.6 years, we were curious how similar fleets had performed. A quick filter showed us that most Kamsarmax / Panamax Companies have a lot of Capes, so no true comparison. Navios is the largest Panamax owner with 17, and has 22 Kamsarmaxes and 36 Capes. SBLK has 41 Kamsarmax, but also 24 Capes and 17 Newcastlemax.

EDRY has sold off the most over the last 13 months, down 61%. NMM, a conglomerate, down 28%, SB down 13%, DSX up 7%, on a total return basis.

With the current market near break-evens, and last quarter TCE of $10,674, below the Company’s stated $13,186/day break-evens, it is prudent to review the liquidity profile, which we believe to be stable with ~38% leverage and $34.8M of cash (1Q23).

Rates are trending up but remain low.

So how does the family position impact investor returns?

One way is through the affiliated Company management fees. Eurobulk, which is the Pittas’ family private shipping vehicle, receives a daily cash fee to management the fleet. Yes, someone has to manage the vessels.

Vessel management fees paid to the Managers amounted to $2,018,800, $2,350,747 and $2,968,073 in 2020, 2021 and 2022, respectively.

The private Company also secures lucrative chartering commissions.

We receive chartering and sale and purchase services from Eurochart, an affiliate, and pay a commission of 1.25% on charter revenue and 1% on vessel sale price. During 2020, 2021 and 2022 Eurochart received $294,933, $856,334 and $932,123, respectively, for chartering services calculated at 1.25% of chartering revenues.

The public Company also borrows capital from affiliated vehicles. While the 8% interest is not egregious, the private entity was able to convert their debt to equity at a substantial discount to NAV!

We reached an agreement with a related party and beneficial owner, Ergina Shipping Ltd. (“Ergina”), a company controlled by the Pittas family and affiliated with the Company’s Chief Executive Officer, to draw a loan of $6.0 million, which was used by us to partly finance the acquisition of M/V “Blessed Luck”.

So to recap, the Management’s family takes a fee for providing the employees, managing the vessels, chartering the vessels, buying vessels, selling vessels, lending money to the Company, and so on. A nice little mousetrap.

Friends Dry Investment Co owns 30.2%, Family United Navigation owns 9.7%, and Ergina Shipping owns 6.3%. In total, ~46%. All various parts of the Pittas family and estate.

So how can we unlock the value in EuroDry’s stock?

“Show me the money” the Dividend Model

The shipping universe has finally woken up to the fact that cash is king. Investors like return of capital. Genco finally did it and many Companies have followed suite. The Norwegian folks are minting dividends, just ask Oystein Kalleklev, CEO of Flex LNG and Avance Gas. If he can do it at two companies, so can EDRY/ESEA!

EuroDry, which has been paying down debt, has not returned any capital as dividends.

Some quick back of the envelope math shows that if EDRY traded at a 12% yield and had 20% interest only leverage, their stock price would take off.

Given the share closed Friday at $14.50, a market cap of $41M, and in theory the dividend vehicle would trade at ~$202M, it seems like there isn’t much to lose. And I know, they don’t have 20% debt right now and earnings are variable and NAT has a mixed reputation and has retail investors and why would it be 12% (Ok that may be a little low in our new interest rate environment) and yeah yeah yeah.

You can bring in a bespoke product or, given the upside potential, just issue equity (I know you wouldn’t do this). But in both cases it looks like a win. Call Mike Kirk, heck, if you do it to both publics, maybe Doug Mavrinac would be available.

Where are the Buy-Backs?

The Company authorized a $10M share repurchase program in August of 2022. They have to date repurchased $3M. So $7M more to go.

Navigator Gas authorized $50M around the same time. It is gone and they authorized another $25M. And implemented a dividend.

Tender Offer

You can’t help but chuckle at the fact that in February 2021 Dorian could not get any attention. Their stock just was ‘it is what it is’. So they did a tender offer.

On Feb. 1, 2021, Dorian’s stock closed at $11.98. The next day they announced a tender offer for up to 14.8% of the shares at $13.50/share. By March 15, the share was at $14.50, up over 20%. Today, the stock is approaching $25.

Although EDRY still has capacity under their current buy-back program, a tender offer highlights the extreme discount to NAV.

Take the Company Private

If you can buy something on the market for ~$15/share and you think it is worth more than $50/share, you should probably make that trade. As affiliated management, you do have the perpetuity value of collecting fees every year, which is powerful. And maybe some estate planning and family drama stuff. But neither of those should be concerns for a US-listed entity. How steep can the discount be before you take it private and cash flow / sell the assets?

In Summary

The Company is well positioned to rebound as rates bounce back out of 1Q. There is little to no liquidity concern and management has a good track record of being steady and highly unlikely to pull a fast one on you (see some other recent deals regarding warrants and so on).

And there is a ton of upside should management take some proactive steps to boost capital returns and the stock price. Definitely a stock to keep an eye on.

Nice post. It's definitely undervalued. Glad to see you used our data!