Pareto Energy, Vegan Burgers, Women at Sea, and OSV Investment Ideas

Pareto Energy feels like ancient history as the volatile market heads into the 4Q. We recap a few key takeaways, discuss some cultural items and dive into an OSV name.

Although the Norwegian government has been quite antagonistic to the oil and gas industry, you could not sense that at this years Pareto Energy conference. Perhaps it was the nostalgia to the old days, a rebirth from the downturns of lockdowns and demand destruction. The Conference does a seamless job of transitioning ‘hot’ sectors to the main stage, the other year the Battery companies were apparently all the rage.

This year, the ‘energy transition’ folks could have saved themselves the trip up the mountain - high energy density oil and gas was back in favor. The drillship Company presentations on the mainstage looked more like TedTalks, sleek screens, headsets and CEOs with great command of the stage. The Valaris CEO worked the stage like he was Steve Jobs presenting the iPhone for the first time. Made you forget about the extreme capital destruction in the sector and how angry investors were last year that management was ‘not being aggressive’ enough in re-chartering their assets.

Solstad Offshore, a Norwegian OSV Company, has a large refinancing coming in 2024. It was standing room only as investors hoped to better understand the range of possibilities. Are we talking massive dilution? Severe asset sales? An alternative lender to come in with great terms? For the most part, listeners left empty handed.

The Pareto Analyst in Q&A asked about certain offshore markets. Highlighting the fundamental flaw with banker led Conferences. Bankers make money on M&A and equity deals. Companies are their clients. So you have to play nice. It is probably not realistic to imagine tougher questions, Companies would just skip those Conferences or say we cannot speak to that because the process is ongoing. But we can dream.

Norwegian media reported last week that investing legend Tor Olav Troim had acquired a small stake, and the market reacted positively with the stock passing 30 NOK for the first time since crashing in March. If you are in need of debt refinancing, Tor Olav on speed dial is like pulling a rabbit out of a hat, just check out Golar LNG.

Although with all the excitement for oil and gas in Oslo, perhaps we will look back on the 2023 Conference as the year to celebrate the practical world.

Break for Cultural Items

Firstly, it must be reported that Pareto served vegans burgers to a bunch of hungry energy investors. The correlation to battery companies on the mainstage and the popularity of vegan burgers is likely high. It should be noted that Beyond Meat has a short interest of 36%.

Then we have the DOF Group Investor Day. The Company has emerged from reorganization, has a large presence in Brazil where PSVs charter at a $10,000/day premium to the North Sea, and is excited about their recent contract wins with Petrobras.

However, we could not help but ignore their cultural goals to bring onboard “all female teams”. Apparently they do not have to pay a premium for female crew members either, so it is a win win for them.

Many Companies aim to increase the percentage of women at sea. Personally, I do not really understand it. The same Companies who smile when they are able to double the time offshore due to ‘covid regulations’, then cheer that they are recruiting women to work offshore.

Ladies, let me let you in on a secret. Working offshore is a horrible job. You are constantly traveling, it is very dangerous, you work 14 hours a day everyday until you leave. Companies are recruiting women under diversity programs, but also conveniently at a time when male seafarers have moved on after 10 years of career impacts from a volatile market. This sets aside any arguments of engineering programs being extremely male leaning, differences in skillsets amongst sexes, etc. Those discussions are a bridge too far for today.

But Ladies, if you are going to sea, make sure you get a premium salary!

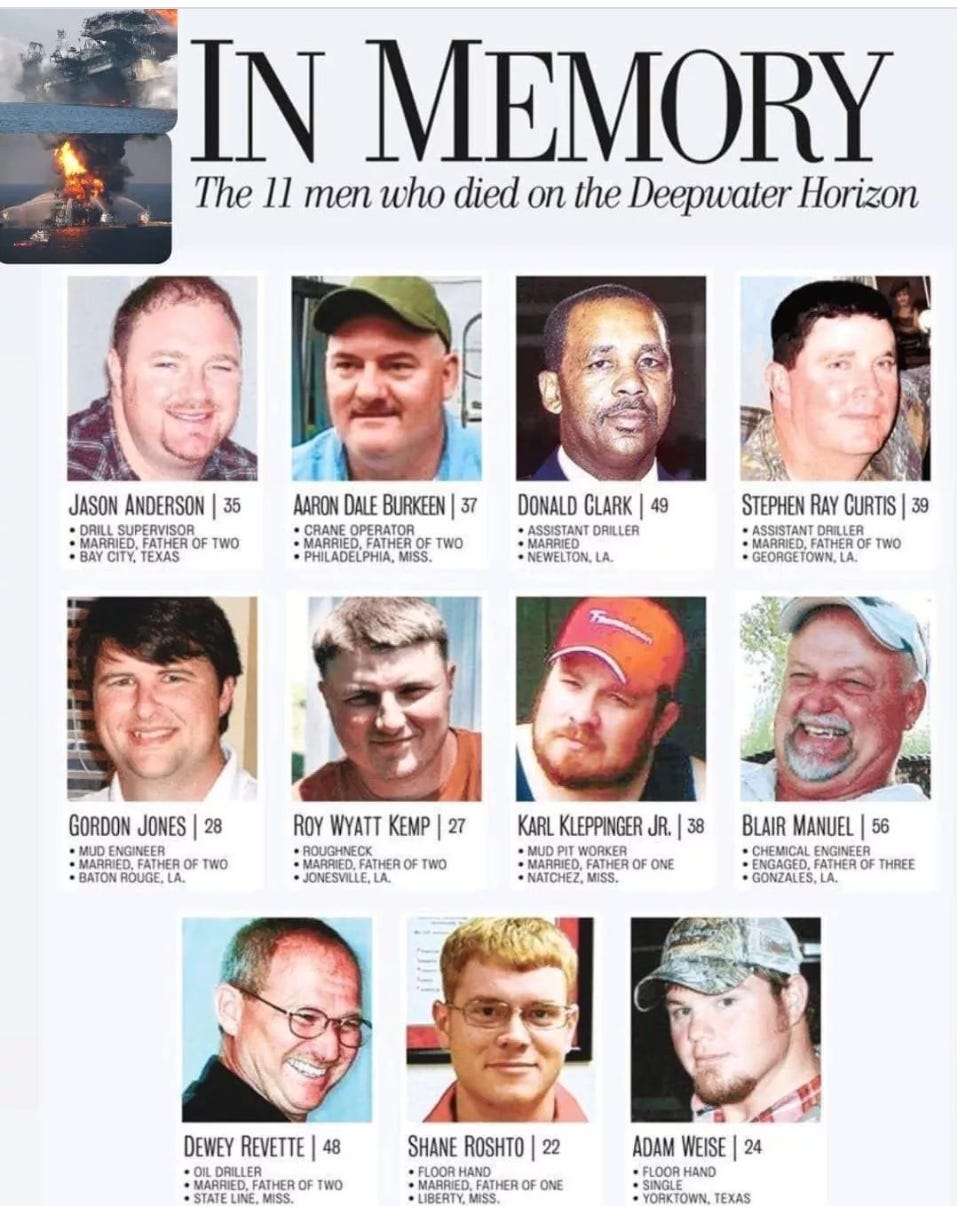

Nobody looks at this picture and says, jeez, what was their ESG score? There were 2 women onboard out of 33.

The souls lost onboard the SS Faro.

Or on the Deepwater Horizon. Nobody claimed, ‘I wish we had created an all-female diversity fire-fighting crew onboard’.

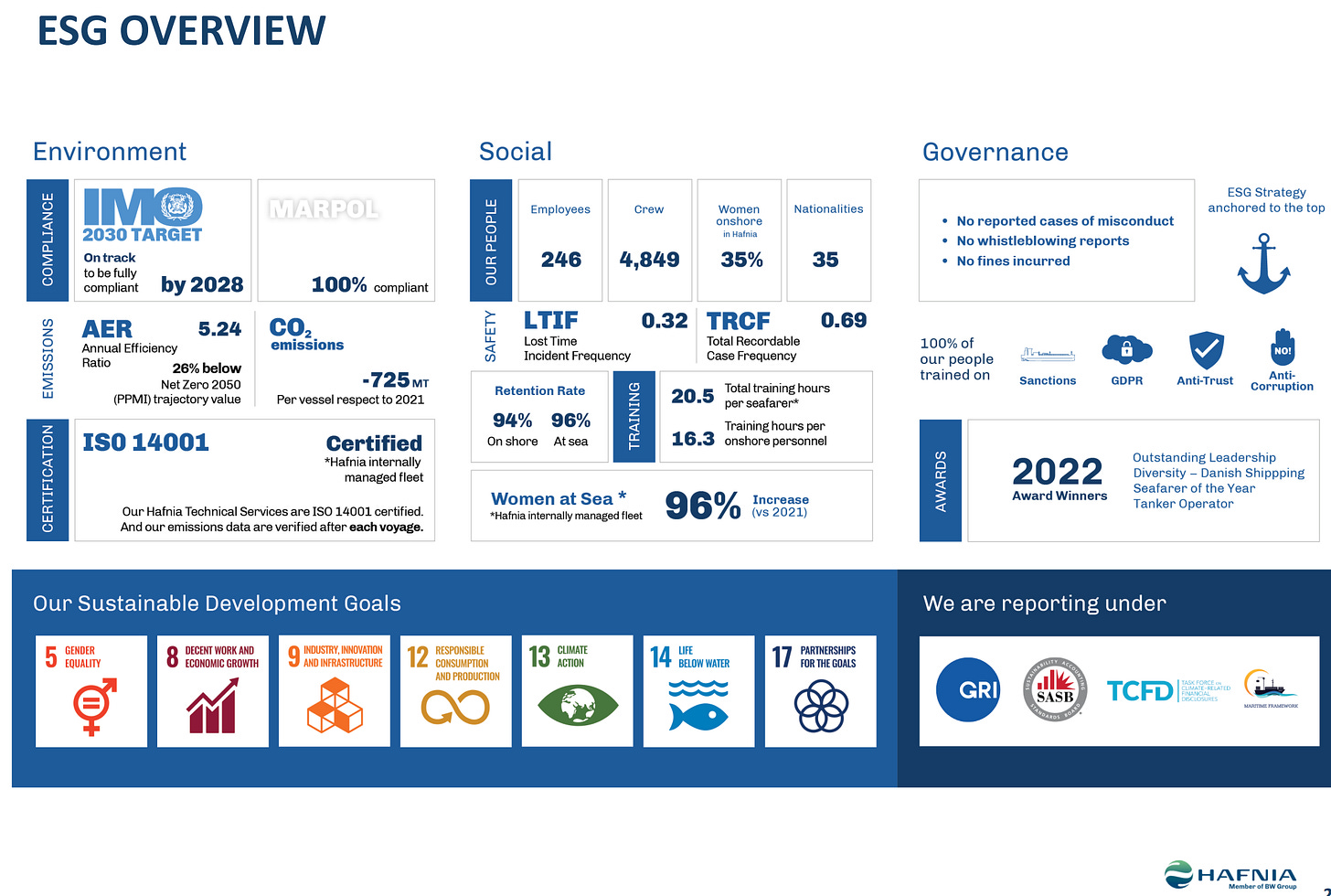

But here we are, Hafnia proudly showing how they improved women at sea 96%. What is that, going from 3 to 5.88 people?!

There are highly talented women who excel at sea. But like every program where you increase a certain group at a preference to another group, I hope it is for the right reasons.

None of these ESG slides ever show how many days a year Filipino sailors spend at sea. Companies highlight adding three women to the at sea division, but then hire de facto slaves to work on the ships for 11 months a year. Ok, so they make more money than they can make staying at home, they choose to do it, they can leave whenever they want, right right I know. We will do another article on the unspoken truths of indentured servitude and modern day slavery across the commodity footprint, we digress.

And we are back. Offshore investment opportunity for small investors.

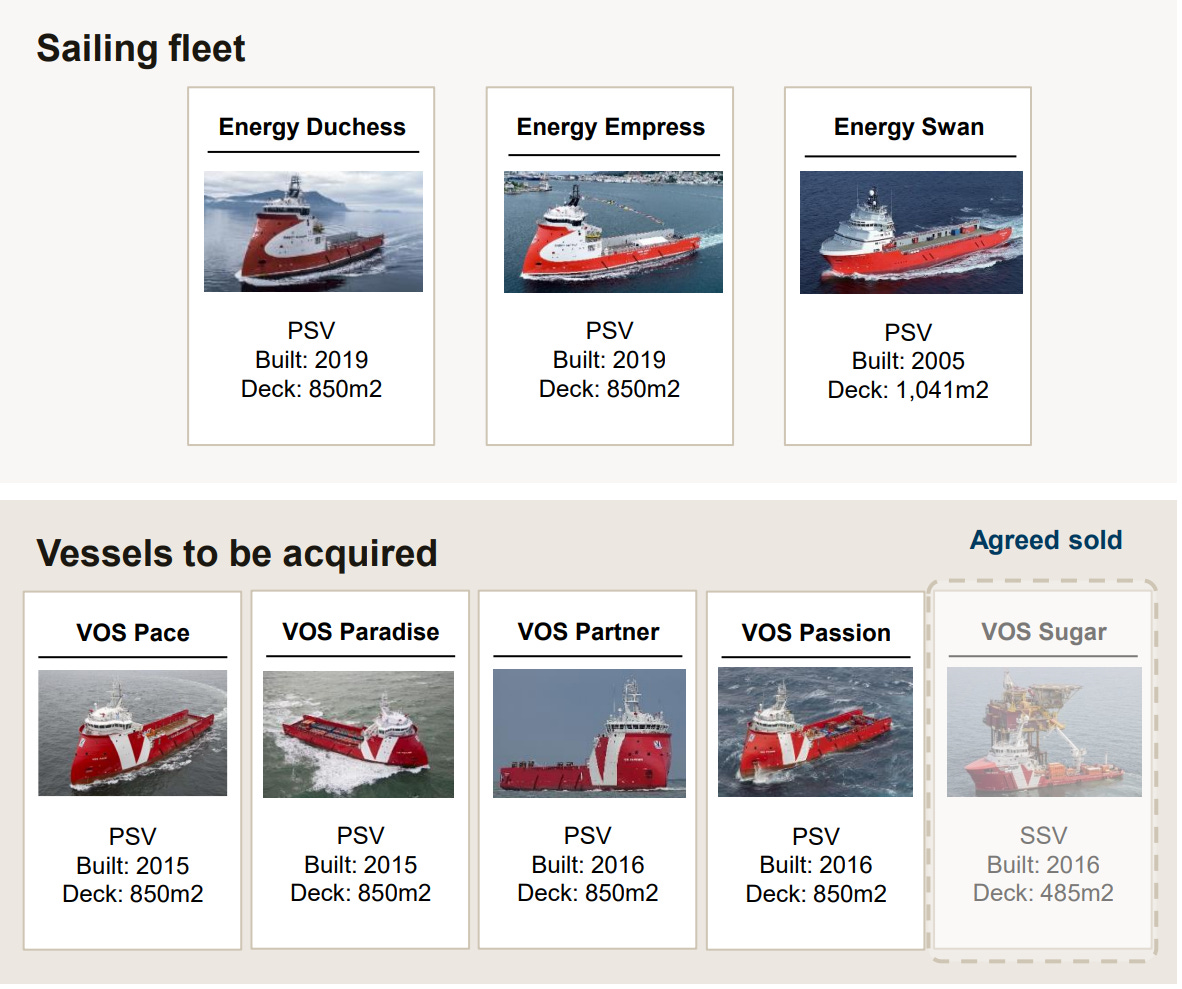

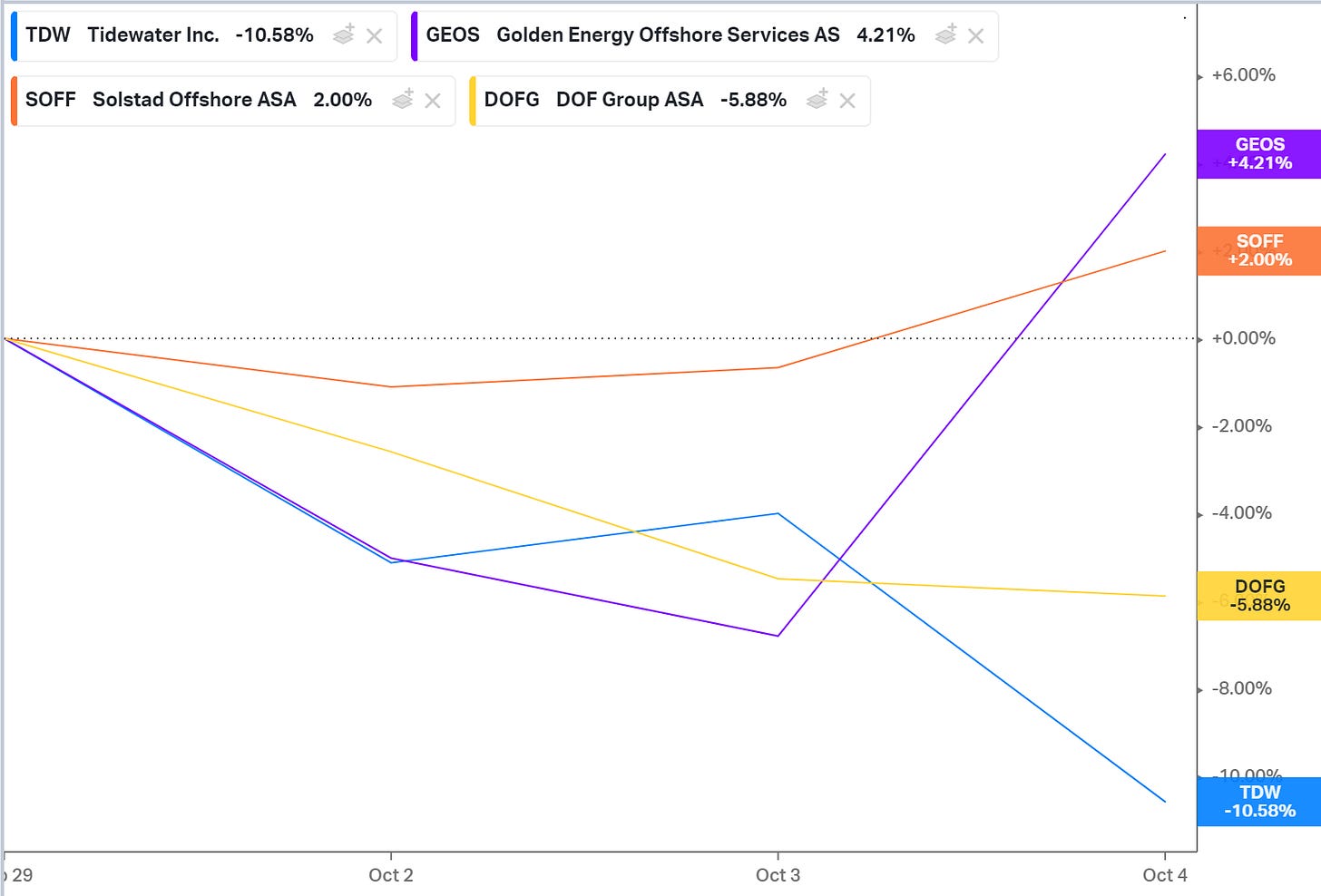

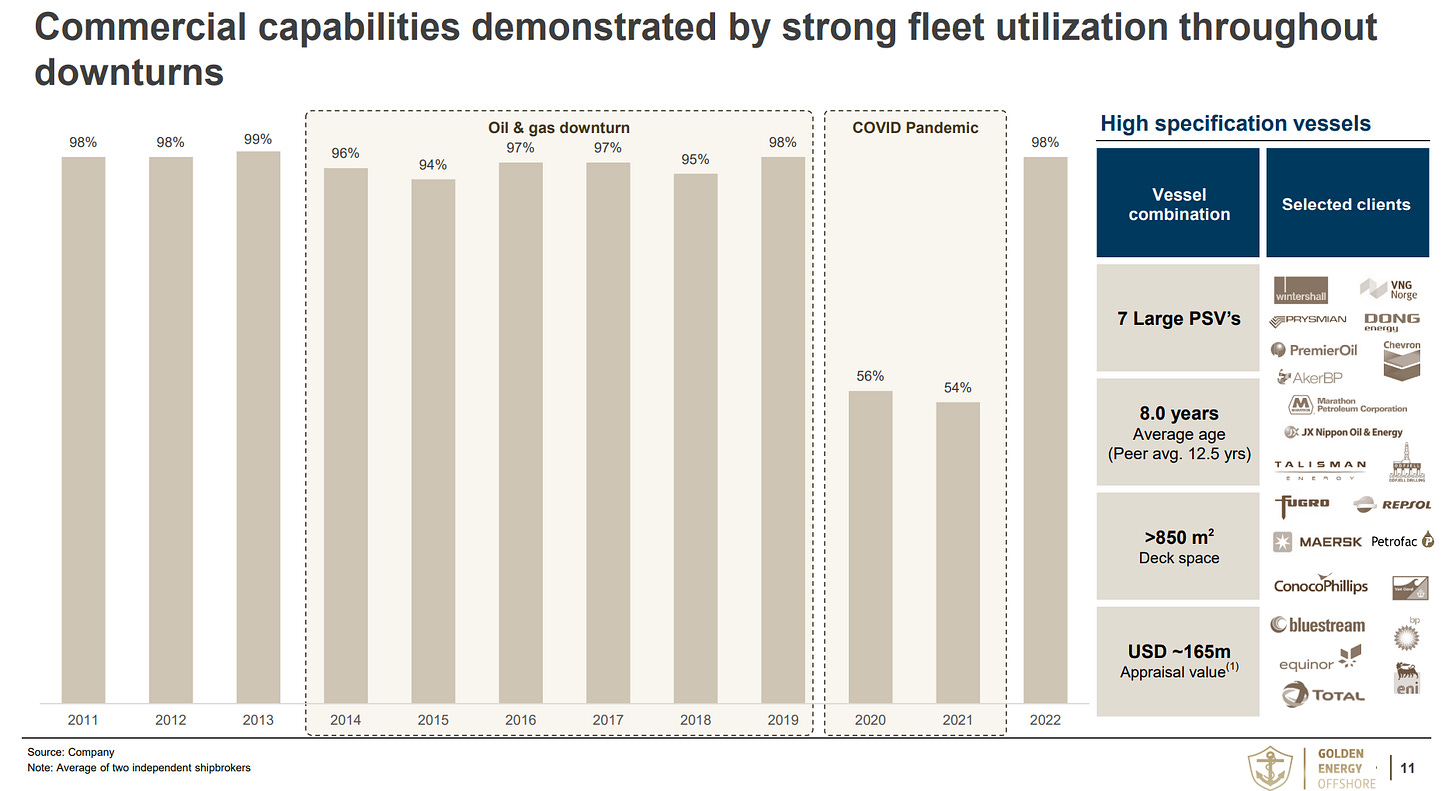

Oaktree took control of Golden Energy Offshore (GEOS.OL). They have acquired a few sister vessels, sold a vessel for a profit, refinanced and capitalized the Company and are setting up to harvest strong rates and the increase in asset values.

The catch is that the Company has a tiny market capitalization and limited float. Hedge funds can skip reading (unless you want to buy the whole thing, we will negotiate the settlement). The benefit is, with limited liquidity, when the market pukes you are protected!! (just a joke)

The thesis is that you are buying assets that can be converted for wind and other ‘ET’ duties as needed below newbuild parity, granted that is pretty much every asset class. At an estimated $30k/day rate, these assets are paid off in 2.7 years and then you have another 15 years of useful life.

Because of a lack of newbuild activity and S&P, offshore assets remain undervalued. Vesselvalues.com recently had a material step-up in value, algos don’t do too well without any data points.

We expect the Company to have strong utilization given their long-standing relationships in the North Sea. You are also seeing tenders from Petrobras in Brazil and activity in West Africa being done at a premium to the North Sea. As a result, oil majors in the North Sea are showing interest in multi-year contracts on assets, otherwise they risk losing assets to these locations.

Ok so Oaktree is in control. We are fine with that. They want to make money too. The intra-Company financing they did with Fleetscape was wildly within market. They did throw a little bridge loan in there, which I am sure was juicy and are converting it to equity, but it is $3M. So, so far so good, Oaktree is setting the Company up for success.

They have reduced their ownership from ~50% to low 40%s with the recent placement and have plans to continue to dilute their holding over time. They do have plans to continue to grow the fleet, so that is one area to keep an eye on.

The appraisals are at $165M + $14M cash. That is $179M less $100M of debt. ~$79M of NAV. With break-evens of ~18,500/d and if they are able to charter the fleet at $26,000/day, that is a FCFE of 71%.

Rates are stepping up. Charters are coming back. The asset resale marketing is firming up and prices are rising. Strong offshore capex environment and GEOS, aka, Oaktree Energy Transition NewCo will be well positioned to benefit.