Rules Based International Order

Russia was once a mainstay of the tanker market, could China be next?

With the one-year mark of the Russia-Ukraine conflict passing, let us revisit the tanker industry as it was and see if there are any parallels to draw should China invade Taiwan. A game of “What-If”, while theoretical in nature, here we are.

The Normal Times

Sovcomflot was the largest Aframax owner in the world, controlling over 100 vessels including crude and product carriers, shuttle tankers, gas tankers and of course, ice breakers. After re-branding as SCF Group to sound “less Russian” and help pave the way toward increased capital markets activity, numerous ‘Western’ banks lined up to finance new projects.

SCF Group agrees funding for six LNG-powered Aframax tankers

ABN AMRO, BNP Paribas, Citibank, ING Bank, KfW IPEX-Bank and Société Générale all participated in the syndication for LNG-powered Aframax tankers. Shell signed long-term LNG supply contracts for the vessels and placed two under contract for ten year long time charters.

Watson Farley, the prestigious law firm marketed their success and Marine Money hailed another transaction as “Project Finance Deal of the Year”. SCF went from being the early mover in the Net Zero movement, to a Company you cannot transact with.

"Sovcomflot and its bankers got out ahead of the curve. The company has demonstrated time and again its forward-facing Board and Management commitment to doing the right thing — and often doing it boldly before the rest."

ABB opened a marine service center in Russia to support Arctic maritime industries, Russian crude flowed to Rotterdam, the World was simple. This all after Russia had moved troops into Crimea in 2014.

Then the Ukraine invasion. Sanctions. Overnight, but also slowly over the last year, the shipping markets were re-drawn, business relationships unwound, and the World is now different.

The Now More Complicated Times

And this is where things get more complicated. China, with the revamped bipolarity in the World, has used this opportunity to buy discounted oil but also to increase and flex their global leadership position.

U.S. Secretary of State Antony Blinken said there is information that China is “strongly considering providing lethal assistance to Russia.”

With the recent jump in Op-eds and articles on Cold War with China, China involvement in Ukraine, China supporting Putin to set stage for Taiwan, etc. - it is clear there are competing factions at play.

China’s military sent 71 planes and seven ships toward Taiwan in a 24-hour display of force directed at the self-ruled island, Taiwan’s Defense Ministry said in December

These flights and military engagements have continued over the winter. Taiwan has ordered 66 more F-16s from the United States as well as other weaponry and extended their mandatory military service for all males from four months to one year.

What would the reaction be if China invaded Taiwan? Would it be similar to Russia’s invasion of Ukraine? Who would be most impacted? How would those many shipowners with Chinese leases be impacted?

A few things are clear. People rarely change their minds or actions, they are influenced by laws and governments. No one stopped transacting with Russia when they re-took Crimea in 2014, but then they cared very deeply about the Donbas.

Regarding China, no one altered business to protest the plight of the Uyghurs and their ‘re-education’. And China has not been punished or reprimanded on a global scale for breaking the World Health Organization’s 2005 International Health Regulations in late 2019, which were put in place after China failed to release information of SARs in a timely matter in 2005.

Don’t Bite the Hand that Feeds You

London (CNN Business) — Europe is becoming increasingly reliant on China for trade, and many of its top companies are eager to invest in the world’s second biggest economy despite the disruption caused by Covid lockdowns. (Dec. 2022)

Trade balance of the European Union with China from 2011 to 2021

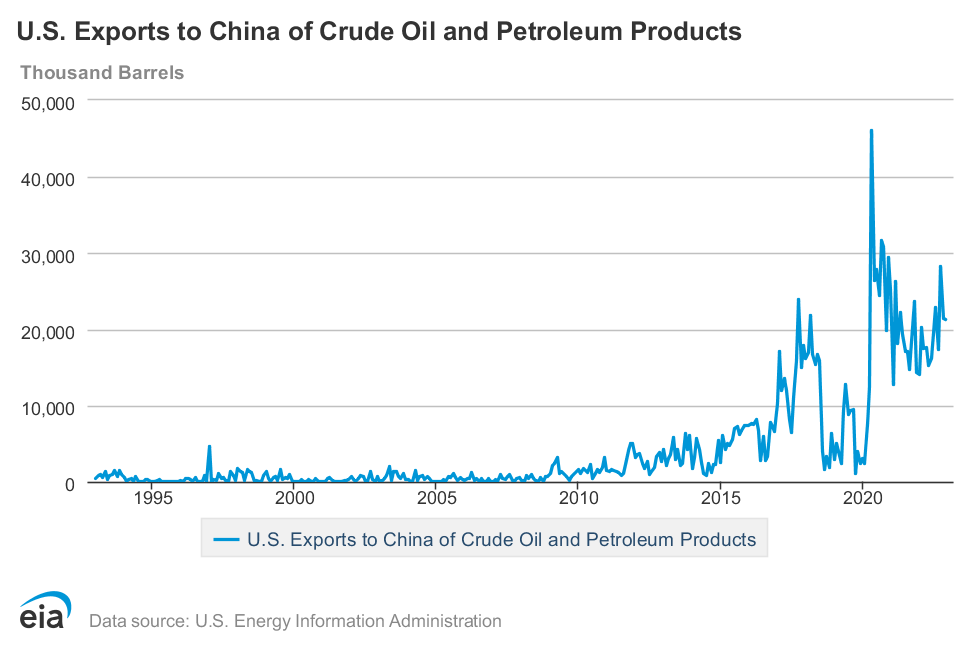

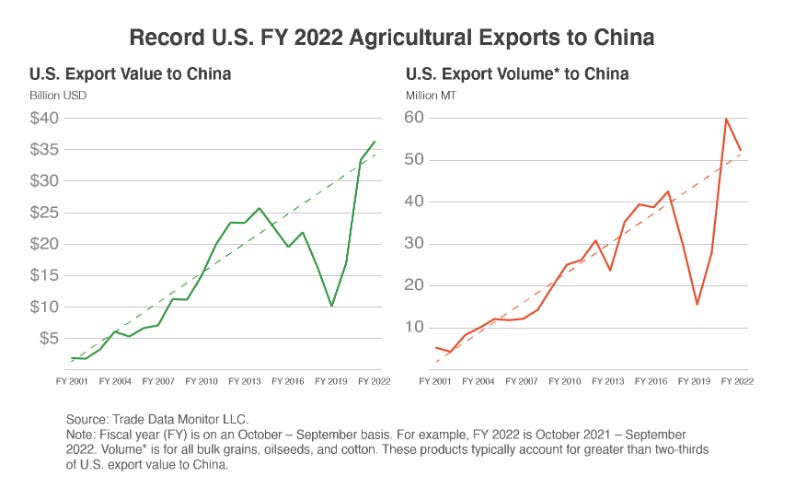

America has long offshored manufacturing. The US Gulf tanker market is particularly dependent on China destined barrels and US agriculture products are a major export to China. Needless to say, America would be greatly impacted.

Summary: China is such a dominant partner to the World’s shipping fleet that any Russia style sanction environment would be so impactful one would rush to sell their fleet before trying to make sense of the fall-out

Western countries are more dependent on China than they were on Russia, not withstanding the Germans and a few neighbors dependent on natural gas deliveries.

Taiwan is not next to Europe and there is less emotional reserve toward Taiwan amongst the USA/UK/EU international order.

Chinese Leasing Could be Impacted Under Softer Sanctions

According to TradeWinds, Chinese leasing companies account for $70Bn to $80Bn each year - a major player as European banks stepped back from shipping after a decade of hardship (although that is changing).

Chinese Leases in the Tanker and Dry-Bulk Sector

Tankers: Euronav (yes), International Seaways (yes), Scorpio (yes), Hafnia (yes), Ardmore (yes), Trafigura (yes)

Drybulk: Star Bulk (yes), Golden Ocean (NO), Eagle (NO), Genco (NO), Seanergy Maritime (not really)

There would be a great deal of re-shuffling should Chinese leases become financing non-grata. Given the leasing house holds the title - it would be more complicated than the situation Golden Ocean went through last year:

In May 2022, the Company suspended time charter agreements with respect to two vessels (Admiral Schmidt and Vitus Bering) and redelivered those vessels to their owners, where the Company understands that those vessels were financed by owners as part of a sale-leaseback arrangement with a Russian-state owned entity

As we mentioned before, geopolitics is unforgiving and moves fast. Should China fall completely afoul of the Rules Based International Order, the shipping industry as we know it would cease to exist so no need to worry. But if it is only partially afoul, and Chinese leases come in the cross hairs, there will be some busy CFOs and corporate lenders.

Appendix: A whole other angle, potentially for next time, how Chinese lending bosses are being removed / ‘disappeared’ / replaced / purged

When it comes to your capital structure, it is best to remember the old adage, “if your loan manager should disappear, lower leverage is premier.”