The Legend of Tor Olav Trøim

“In a time of deceit telling the truth is a revolutionary act.” - George Orwell

Three Sheets is now an official Tor Olav fan account. Speaking to the Marine Money attendees in NYC last week, Tor Olav Trøim opened up about some of the difficulties he has faced the last few years, mentioning “going through hell” a few times, in what came across as very humble and sincere. And while we do not know the details, we assume he was mostly referencing the extremely challenged markets through global lock-downs and the demand destruction that followed.

That said, it may also have also had something to do with his personal life, his wife made international news as certain old news stories resurfaced. But as an official ‘Tor Olav fan account’ and are focused on the extremely positive outlook for Himalaya Shipping (which we will cover after the juicier stuff) and Tor Olav’s latest role as a voice of sanity in the global shipping net zero circle.

“In a time of deceit telling the truth is a revolutionary act.” - George Orwell

Censorship has become a major part of the modern political and corporate world. It is perhaps not that surprising for those who follow history, but the more nuanced bit is ‘self censorship’. The act of keeping relatively accepted or logical views to yourself, due to the fear of repercussions from small but powerful factions.

That is why it was like a weight was lifted off the attendees shoulders when Tor Olav shared such basic, but in modern terms, controversial opinions.

It is more impactful to provide energy for hundreds of millions than it may be to put a transgender on your Board.

Not exactly a wild concept and one which, in a normal world, we would be pretty on par.

Lloyd’s List, who is typically on the other side of the spectrum, quickly launched an article.

His comments went unchallenged by Tusiani and the audience, many of whom also laughed when he said he was “not ashamed” for prior comments saying he was “tired as sh*t of environment, social and governance policies”.

They went unchallenged, can you believe that, these people, who do they think they are!!

Tor Olav noted that Western and Asian nations are stripping Africa of their resources and putting better systems in place for those countries to retain that wealth, like Norway has done, would be a social good. Pretty logical if you ask me.

It takes great courage to make public statements like this. And yes, many say well ‘if I had hundreds of millions, I would tell the truth too’. But it doesn’t really work like that.

At Nor Shipping the other week, John Kerry, the US Climate Czar (who owns a fleet of jets), compared those against net zero as akin to Nazis, using violent political rhetoric which has become all too common. Other ‘powerful’ people claim he is ‘not just irresponsible but bordering on indecent’. Well, he did it again, assaulting the Marine Money Conference with indecent exposure.

At Three Sheets, our current investment criteria is as follows:

Tell us what makes sense even if unpopular

Provide dividends / shareholder return, as frequently as possible

We covered #1 (probably in more detail than we should have) and #2 is why Himalaya Shipping seems to have a great model in place.

Dividend Policy

Intention to distribute free cash flow as monthly dividends once the vessels are delivered. -Investor Presentation

And obviously with dividends, the devil is in the details. But monthly dividends sound like a good start. Although, note that Himalaya has put Asian leasing in place with very high leverage and the ships don’t finish delivering well into 2024.

The Fleet

While we do admit it is a little odd that they had 2020 Bulkers and sold out to relaunch what is essentially 2023 / 2024 Bulkers, we won’t dwell on that much. They will have the most efficient fleet in the industry when all vessels deliver.

Because of this, on an adjusted basis, they will have break-evens of $13,921 after you proforma for how awesome and modern their dual-fueled fleet will be. Older ships will be slowing down, the Regulatory zealots in the EU / UN / IMO / TRAFI / ETC. are only gaining momentum.

There will be a cost of carbon, I am sure Vitol and Trafi are probably lobbying hard for this as we discussed previously. Even Janet Yellen the US Treasury Secretary is already onboard. They are “on the fence”, code language for ‘we are putting systems in place before announcing next year’.

And Tor Olav’s ships will be the beneficiary.

And yes the orderbook is at all time lows. This is on a percentage basis, not a nominal basis, but even still it looks very enticing. And, according to them, ton-mile demand has even outpaced volume growth, so the large growth in DWT on the greyed section below is less impactful.

But owners will just order more ships!

Well this may be true, but the biggest fleet growth in history took place in the late 2000s. So some of those ships are already approaching 20 years old and the number is accelerating.

Plus, the number of shipyards has collapsed. So even if you want to, it will be tight and likely more expensive.

So everything sounds pretty great. Is there any downside? Well the iron ore they carry goes mainly to China. Yes India and other nations are increasing demand, but it is mainly a China game at the moment. And no one knows what is going on in China. Remember when Evergrande was in the news everyday? Remember Jack Ma?

We had no idea about this, even if you don’t finish this article, check out these replica cities, fascinating. Replica Cities in China

And, half the ships deliver in 2024. So if you are a looking for a quick dividends, this might not be the name for you.

Tor Olav came to New York to show people the light (yes, and to support his investment). Shipping Influencer Ed Finley Richardson tweeted the presentation.

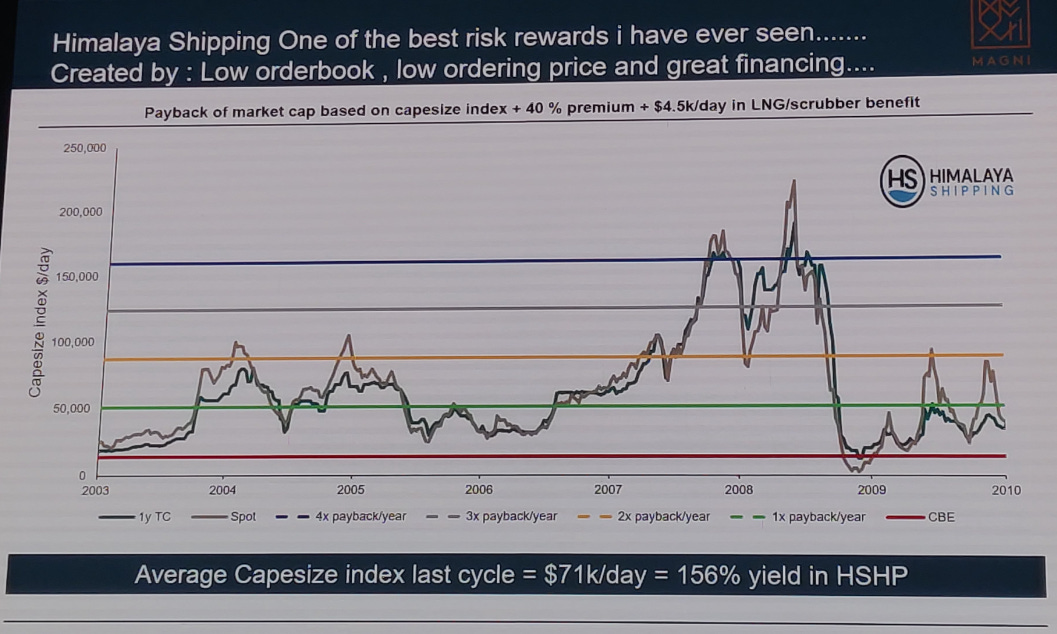

He was discussing yearly payback levels at relatively modest/achievable rates. So at $50,000/day you are saying I make my money back in one year you are telling me!? Speaking in terms like this kind of blows our mind.

So best case scenario, we enter another super cycle and you are yielding 156% at $71K/day, downside, we tick along at decent but lower market levels into perpetuity and you remain cash flow positive given the break-evens and extreme efficiencies of the fleet. Don’t forget, Cape rates have already been at these levels at times since 2021.

Like Tor Olav says, “one of the best risk rewards I have ever seen…”

Now you see where the smile comes from.