The Battle for the 'Sea', Seatankers vs. Seaways

Fredriksen moving from one tanker competitor to the next. We look at the recent back and forth between Seatankers and Seaways, and discuss the merits of the latest Viking Raid. Does he have a point?

Back in the dark days of February, we wrote about the Last Viking John Fredriksen and his battle over Euronav. After taking the scalp of Hugo de Stoop in his ongoing battle/draw, he is now ramping up his fight of words with the management of INSW.

We love the drama. Pop the popcorn and turn up the volume. We review the letters and ask, does he have a point?

Ok, so every tanker Company should be run by one firm obviously, right? Then they could keep rates firm against the Chinese, Saudi, oil (energy transition) traders, oil majors, etc. They may even bring some discipline and order ships according to supply and demand and not the roulette options style where anyone with a few million and a big ego can place a 4 option 4 newbuild order.

That won’t and can’t happen, but there is definitely room for consolidation, a constant theme in banker pitch books. We read the latest letter from Seatankers and went through their presentation. Their legacy and background speaks for itself. They make some good points. And we are open to being convinced.

But first a quick comparison.

The first rule of telling the world that you are better than someone (making a nifty powerpoint slide deck and sending strongly worded emails to management) is to make sure you are.

Since May 2019, INSW has outperformed. Since May 2021, INSW has also outperformed. And since May 2022, they are tied essentially!

Now we know they have different fleets, etc. And maybe there is merit in “but but, INSW could have done much much better!”

FRO has 68 vessels, 22 VLCC, 26 Suez, 20 LR2/Afra. INSW has a more diversified 76 vessels, including 13 VLCC, 13 Suez, and 37 MRs, amongst others.

Frontline is trading above or near NAV. INSW at a 30%+ discount to NAV!

In reverse order, INSW rebuttal: Link Seatankers Letter: Link Original Deck Sept. 2022: Link

INSW pulls the Diversity Card

Seatankers accuses you of destroying shareholder value because your stock trades over $500M below where it should (it should trade at or above NAV) and you respond with

“Notably, Seatankers is targeting – without explanation – two of the three women on the Company’s Board, each of whom bring significant industry experience and expertise”.

The use of the term “without explanation” is interesting, because in the Seatankers’ letter they state with decent explanation.

Despite INSW's own admissions that "a full Board ranging in size from five (5) to nine (9) members is optimal," the Company continues to maintain an inefficient and bloated 10-member Board.

So far we were on team Seatankers – the INSW Board is too big and frankly has a bunch of legacy members from the OSG / Bankruptcy / Diamond S days that may be better off moving on.

But then Seatankers states one of the Board members they will not be voting for is CEO Lois Zabrocky.

HaHa OK.

Just say management should resign and merge with you. Are there any decent companies where the CEO isn’t on the Board? Frontline has the CEO and the CFO on their Board.

Verdict: Zabrocky should stay, Seatanker loss.

A brief note to INSW: Having Randee Day and Alexandra Blankenship on your Board does not really make it more *diverse*. These appointments are more akin to corporate drones who sit on many Boards, ensuring a similar thought process and strategy.

Let us get back into the original arguments:

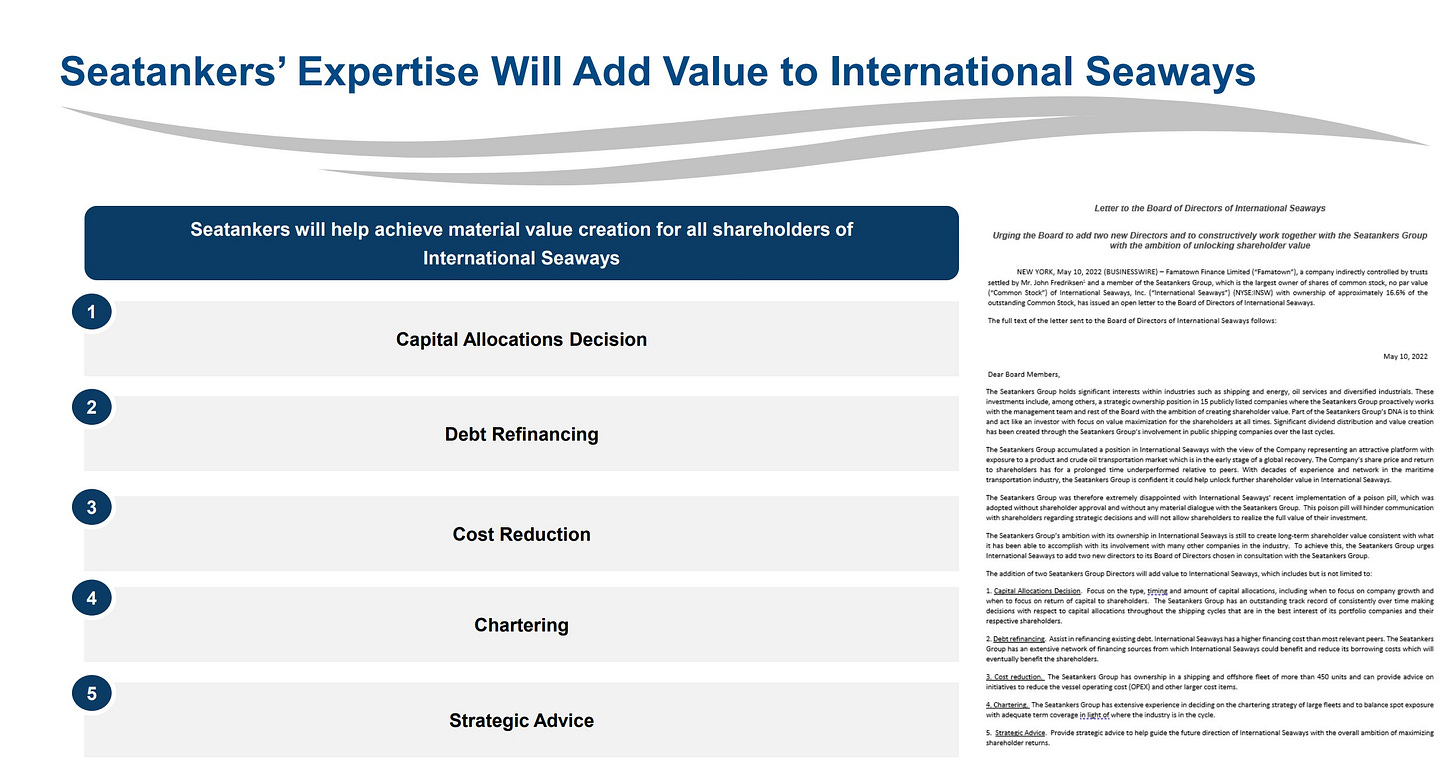

The deck starts by saying Seatankers manages a bunch of public companies.

Ok that is nice. They also managed Seadrill through a couple bankruptcies, etc. That said, we do think INSW could use some of the Dividend King Oystein Kalleklev energy…

We rate this claim as marginal.

They can do a better job with capital allocation, debt refinancing, cost reduction, chartering, and strategic advice.

A round-about way of saying let us take it from here.

Capital allocation and debt refinancing.

Debt refinancing is a marginal claim at best. INSW CFO Jeff Pribor has extensive experience as a public company CFO and an industry leading investment banker – INSW has reduced debt, done Chinese leasing, worked with the most cost competitive banks, and so on. Contrary to Seatankers belief, you do not get much of a bank discount because John Fredriksen’s trust owns your stock.

Capital Allocation, well this is a big bucket! And maybe our first action point.

I suspect what Seatankers means is return of capital to shareholders. Do they also include the well timed acquisition of Diamond S? The argument of: We Seatankers pay dividends and you INSW are only just ramping up your dividends, but now have a strong shareholder return strategy, doesn’t really hold water.

INSW management arguably could have been more aggressive a few years ago in reducing leverage and getting dividends to shareholders, but they did step up and acquire Diamond S at a cyclical low-point.

Now INSW has 21% net leverage, a diversified fleet, a dividend strategy and FRO has 53% leverage, and did not acquire any mid-age fleets with heavy clean exposure over the last few years. They did acquire VLCC newbuildings and relatively new Suezmaxes from Trafigura, where they issued 8.5% of the Company to Trafi at $8/share. And set up a side-car bunkering deal with Trafi to do related party transactions and so forth.

Verdict: Not very straight forward but Seatankers hasn’t made the case. INSW management has steered their ship well. INSW.

Cost reduction and chartering. Here is a data point with merit.

INSW management has set up a mutual fund of ship management (excluding Tankers International, which is a different deal). And like the legacy wealth managers who bleed you dry for 50 to 100 bps a year and then just put you in mutual funds that also have a ton of fees, INSW has a well-paid commercial desk that decides which pool to manage their vessels.

Check out our take on pooling in our Heidmar recap. But it goes something like this. Let us manage your ships, we charge you a nice daily fee, we take ~2% commission on all freight, we buy you bunkers for another fixed fee, and every now and then we host a happy hour or have a pool meeting somewhere exciting.

Trust us, our CEO who is on his yacht in Monaco, or flying his private plane to watch futbol matches, or fishing in the Florida Keys is going to be quite fussed if your ship leaves a little on the table when fixing!

Take INSW’s Aframax fleet for example. They have 4 ships with Concord Maritime, a sub-scale pooling Company that manages like 8 ships. Penfield, who manages their Suezmaxes, has an Afra fleet that is almost 3x bigger!

Management should demand an equity stake for supporting this pooling company.

This means that INSW paid Concord Maritime conservatively over $2M to fix the four vessels for the year. Zabrocky used to run chartering, she could probably have chartered these ships on her commute!

We believe that Fredriksen has the right model of more in-house chartering functionality. Industry leading public companies should not be outsourcing commercial management to small scale pool operators.

Verdict: Seatankers.

On the Cost Reduction claim.

We just identified leakage from INSW in their Chartering scheme. And with G&A of $46.4M for 64 shore-side staff and FRO with $47.4M for 78 employees, Frontline has the edge, especially since they are not pooling out their vessels.

During 2022, general and administrative expenses increased by $13.2 million to $46.4 million from $33.2 million in 2021 - INSW G&A

Clearly a lot of capital being spent to run these vessels.

Verdict: Seatankers could reduce costs and eliminate a lot of G&A.

Strategic Advice

The unsolicited advice to-date hasn’t been particularly ground breaking. Tie.

In Summary

You can talk until you are blue in the face about cutting costs and strategic advise. But the elephant in the room is Frontline has a history of trading at or above NAV. INSW does not currently trade in the same zip-code as NAV.

As you can tell, our own analysis here is a roller-coaster. INSW management has done a good job, but in thinking it through, it may also be time to pass the torch.

$47M in G&A + endless fees to manage the vessels is a newbuild MR leaking out of midtown Manhattan every year.

Final Answer: Fredriksen should be able to buy more shares at NAV (remove the Poison Pill), and because he historically trades (as they claim) at a premium, he will obviously be happy to do this.

If he can get the shareholder vote and buy the stock. This seems fair. Shareholders can place their bet that the stock will trade up to Frontline’s prestige. Or they can vote to stick with the team they have.

Alternate Proposal: Three Sheets management will take over INSW at a 70% salary discount to current management. We will spin the MRs into an end of life dividend company that runs older ships until they are scrapped. We will give commercial management of the crude vessels to Seatankers. The new Seaways will sell its newbuilds and focus on 5-15 year assets, dropping them to the EOL dividend vehicle at 15 years. We will be a high dividend payer, which will push us above NAV, and we will issue equity to grow. Financially arbitraging equity above NAV for steel at NAV. Talk about Strategic Advice!

We need to think this through more, it just came to us at the end, but we might be onto something. Like we said, there are a lot of places to cut costs and the newsletter remains free!